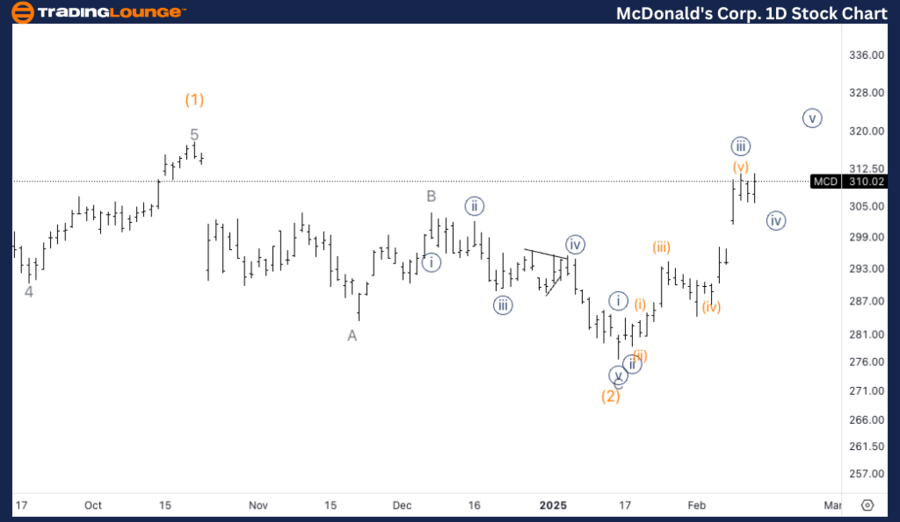

MCD Elliott Wave technical analysis – Daily chart

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Motive.

-

Position: Wave 1 of (3).

-

Direction: Approaching a top in wave 1.

-

Details: Expecting a top in minor wave 1, ideally near the previous wave (1) high, followed by a pullback before resuming the uptrend above $300.

Daily chart summary

MCD is currently in the final stage of impulsive wave 1 of (3). We anticipate a top forming soon in minor wave 1, likely near the previous wave (1) high. After reaching this peak, we expect a pullback before resuming the uptrend, with a target above $300 in subsequent waves.

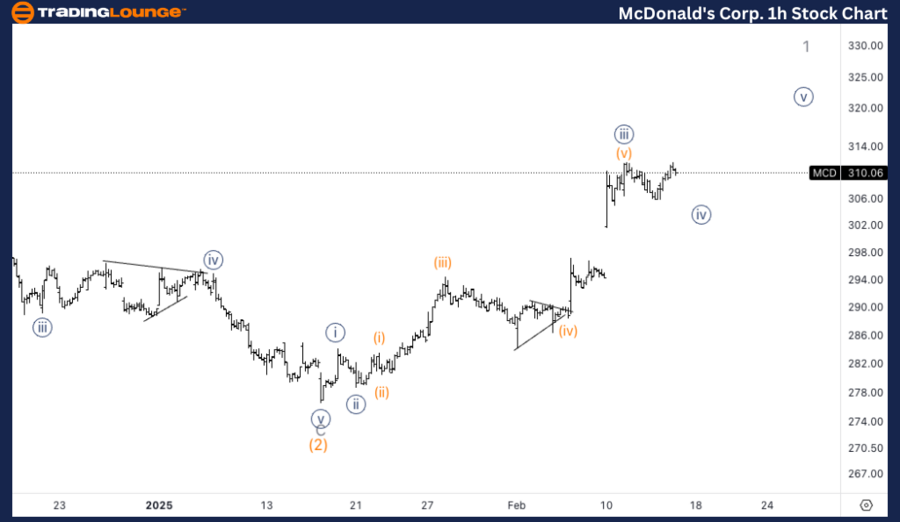

MCD Elliott Wave technical analysis – One-hour chart

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Motive.

-

Position: Wave {iv} of 1.

-

Direction: Bottoming in wave {iv}.

-

Details: Wave 1 is subdividing, and we expect another push higher into wave {v} to complete the current uptrend.

One-hour chart summary

On the 1-hour chart, MCD is currently in wave {iv} of 1. A correction is expected to complete, followed by another push higher into wave {v}, signaling the completion of wave 1’s current uptrend. This final movement will confirm minor wave 1’s top.

McDonald’s Corp. (MCD) market outlook

This analysis of McDonald’s Corp. (MCD) examines both the daily and 1-hour charts using Elliott Wave Theory to assess current market trends and forecast future price movements.

McDonald’s Corp. (MCD) Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

![McDonald’s Corp. (MCD) Elliott Wave technical analysis [Video]](https://www.daystarnews.com/wp-content/uploads/2025/02/5568-mcdonalds-corp-mcd-elliott-wave-technical-analysis-video-750x375.png)